As the independent owner of First Choice MSI, I offer personal benefits you won't find with large banks or merchant services. Notably, you'll have direct access to me via my personal cell: 407-467-6025, available even on nights and weekends. Your success drives mine, which is why prompt support is crucial. Should a payment issue arise on a bustling Saturday, you won't be left waiting days for a resolution-it's about getting you back up and running swiftly.

Typically, I offer solutions ensuring seamless business operations, even amidst challenges. What sets my service apart is the high-quality, cost-effective support that doesn't just rival, but surpasses the competition. With over three decades in the field, my knack for innovative solutions often translates to notable savings for you!

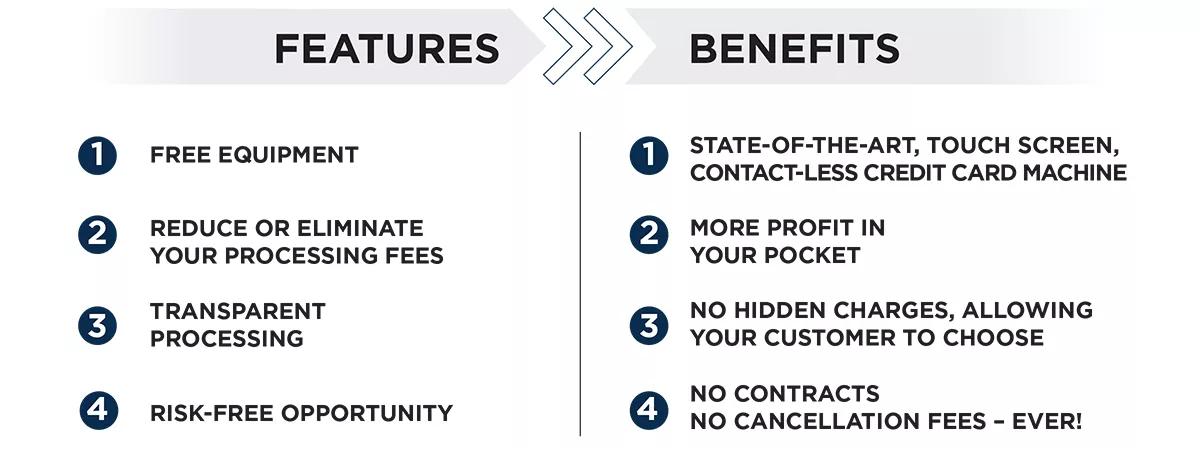

Inquire about First Choice MSI "Dual Pricing Program" that can eliminate your credit card fees!

If we can't match or beat your traditional (Interchange Plus) pricing program, First Choice MSI will reward you with a $500 Visa gift card*. Experience the freedom of "No Term Contracts" while enjoying competitive rates.

By the way, if you're concerned about the hassle of getting out of an unwanted agreement, I regularly help merchants avoid cancellation fees and save you money in the process. So pick up the phone and give me a call. Again, my name is Maurice, I own the company, and my personal cell phone number is 407-467-6025

Eliminate credit card fees with the Dual Pricing program. Whether you are a restaurant, dry cleaner, hair salon, health spa, veterinarian, auto mechanic or specialty store, the DUAL PRICING program virtually eliminates the cost of accepting credit cards.